Tax Increment Financing (TIF)

Tax Increment Financing (TIF) is a new redevelopment tool in Albuquerque that allows a portion of increased tax revenue within designated areas to be reinvested locally, spurring long-term economic growth and revitalization.

Information to Download

Tax Increment Financing (TIF)

BID-TIF-TIDD Overview

TIF FAQ's

New: Tax Reporting Code for Downtown and West Central Businesses

As part of the launch of Albuquerque’s TIF program, a new reporting requirement is now in effect for businesses operating in the Downtown and West Central TIF districts.

Downtown TIF District

- New Location Code: 02-701

- Effective Date: July 1, 2025

West Central TIF District

- New Location Code: 02-703

- Effective Date: July 1, 2025

This simple reporting change ensures tax revenue is accurately credited to the new TIF districts and reinvested into improvements that directly benefit the applicable area.

See Tax & Rev Location Codes for more information.

What is TIF?

In New Mexico, Tax Increment Financing (TIF) is a financial tool that allows local governments, like the City of Albuquerque, to dedicate resources for catalyzing new development.

Albuquerque’s Metropolitan Redevelopment Agency (MRA) can designate any of the City’s Metropolitan Redevelopment (MR) Areas for TIF, which means that a portion of the natural increments in property tax revenue and gross receipts tax (GRT) revenue over time can be reinvested in the area from which these revenues originated, helping spur development in areas that need greater investment. These areas are generally called TIF districts.

In December 2024, the Albuquerque City Council designated its first TIF districts. TIF districts across the country are designed to spur catalytic investment and economic development in designated areas. In the State of New Mexico, TIF districts may only be established in Metropolitan Redevelopment Areas, and as of January 2025, cities, counties and the State may all agree to set aside a portion of the increment in property and gross receipts taxes to reinvest them directly in the areas from which they came over time. TIF encourages a cycle of development and reinvestment in an area that would not otherwise occur without this public intervention.

BID-TIF-TIDD Overview

Business Improvement Districts (BIDs), Tax Increment Financing (TIFs), and Tax Increment Development Districts (TIDDs) may all sound similar, but they are each distinct financial tools. We can use each one to contribute to the community, and strengthen businesses and the economy in different ways.

|

Business Improvement District (BID) |

Tax Increment Financing (TIF) |

Tax Increment Development District (TIDD) |

|---|---|---|

| Purpose: Enhance business areas with extra services like cleaning, security, and lighting. | Purpose: Reinvest part of increases in tax revenue into local development. | Purpose: Fund infrastructure projects like roads, schools, and utilities. |

| How it Works: Funded by property owners and often managed by a nonprofit board. | How it Works: Funds both public and private projects like housing, sidewalks, and commercial centers. | How it Works: Uses a portion of tax revenue increases, overseen by local government. |

| Key Benefit: Improves the area for businesses and customers. | Key Benefit: Supports economic growth and revitalization in the area. | Key Benefit: Focuses on public projects that benefit the community. |

Frequently Asked Questions (FAQs)

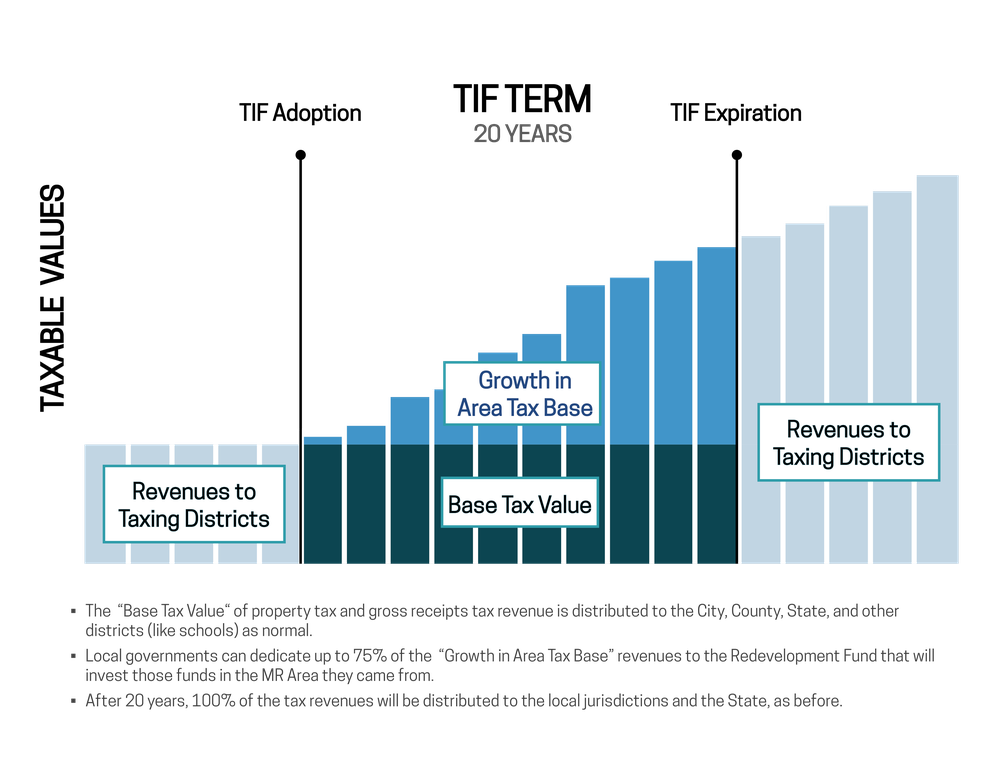

Will TIF increase taxes?

Establishing a TIF district does not increase taxes. In a TIF district, MRA receives a portion of the gradual, natural increment in tax revenues over a 20-year period above the base revenues from the year the TIF was established. For example, a portion the annual property tax increase or gross receipts taxes from new businesses that open in a TIF district could be reinvested directly in that TIF area. The City, County, and State may dedicate up to 75% of the tax increment from an approved TIF district to the Metropolitan Redevelopment Fund for projects within the TIF district, leaving the baseline tax revenue and at least 25% of the yearly increased tax increment to the City, County and State.

Will TIF districts take funding away from other parts of the city?

TIF districts do not take any existing funding away from other areas of the City. There would be no negative impact to schools (APS), flood control (AMAFCA), or other special taxation districts. These districts would continue to collect at their regular tax rate and benefit from the tax base growth. Critical services like public schools and flood control receive their full tax increment. By investing in redevelopment areas, the economy and tax base grow for everyone.

How long can TIF revenues be collected?

Local jurisdictions can collect TIF revenues for up to 20 years. After 20 years, when the TIF district expires, 100% of the tax revenues will be distributed to the City, County, and State, just as before the TIF district was established. It is expected that these taxing entities will all see material increases in revenue to their general funds—in excess of what would be expected had the TIF district not existed to incentivize development.

Why is TIF important and why now?

TIF is a tool that has been used for decades in New Mexico, as well as in other states and cities to finance development and infrastructure projects and invest in catalytic economic development initiatives that create jobs and increase the overall tax base.

Previously in New Mexico, State law only allowed TIF for the collection of incremental property taxes for individual redevelopment projects. Examples of TIF projects under the former Metropolitan Redevelopment Code are Old Albuquerque High, Villa de San Felipe Apartments, and the International Marketplace. The new TIF legislation now allows for the collection of gross receipts tax (GRT) revenues and the collection of TIF revenue for an entire MR Area, not just a project. The addition of the GRT increment means that TIF has the potential to be a much more powerful tool for New Mexico communities. With these new TIF rules, a jurisdiction could collect over 20 times more TIF revenue, which will have an enormous impact on the scope and size of redevelopment projects that can be funded in a TIF district.

How is TIF different from a TIDD or BID?

Tax Increment Development Districts (TIDDs) and Business Investment Districts (BIDs) are other tools that can be used by governments in New Mexico, in partnership with developers and businesses, to make infrastructure improvements in a particular community area, like a TIF. However, both TIDDs and BIDs require additional fees to be paid by property owners to fund the district improvements. For a TIF, property owners do not pay additional fees or taxes. The TIF is funded through over-time increments in existing sources of tax revenue.

Where can TIF Districts be created?

TIFs may only be established in MR Areas with Plans approved by the local government. There are 27 jurisdictions in New Mexico with MR Areas and the City of Albuquerque alone has 22 distinct Metropolitan Redevelopment Areas with approved Plans.

In order for the MRA to create a new TIF district, a Metropolitan Redevelopment Area boundary must first be designated by City Council. Then, an MR Area Plan must be approved establishing goals for redevelopment in the area and identifying priorities for projects that may be funded by TIF revenues. Either concurrently or after the approval of a Metropolitan Redevelopment Area boundary and plan, City Council may approve the use of TIF in a Metropolitan Redevelopment Area.

Why not designate all Metropolitan Redevelopment Areas as TIF districts?

A TIF district will only create more revenue if the area itself is capable of large-scale development and redevelopment that will increase the rate of recovery of property tax revenues and gross receipts tax revenues over time. Not all Metropolitan Redevelopment Areas, either because of their size or due to the types of development they attract, will lead to substantial increases in the tax base over time. For example, areas with primarily residential development that do not have businesses that will generate more gross receipts tax revenues, generally do not do as well as TIF districts. Areas with a high concentration of vacant or underutilized commercially zoned land, on the other hand, can mean a high TIF revenue potential.

For this reason, MRA works with consultants to complete a market study of any potential TIF area before recommending it to City Council to make sure that there is a reasonable rate of return expected for the area and that the TIF district will produce enough incremental tax revenues to be reinvested in catalytic developments.

Will TIFs be managed by a board or commission?

The State MR Code does not require that TIF funds be managed or disbursed by a special board or commission. Jurisdictions can decide how their TIF funds are managed. As the City awaits the initial TIF funds, MRA will develop procedures to guide how the TIF will be managed and the approval process for TIF projects, taking into account existing City ordinances, policies, and procedures.

How much money will a TIF district get?

How much money a TIF will generate depends on the value of new development and businesses in the area over the 20-year life of the TIF district. Once a TIF district boundary and the rate of TIF recovery are established by the local legislative process, MRA notifies the other taxation districts (County and State) and the “Base Value” of property tax and gross receipts tax revenue is determined. Under New Mexico state law, up to 75% of the “Growth in Area Tax Base” revenues over a 20-year period may be dedicated to a Redevelopment Fund. The MRA can then invest those dollars in the designated TIF districts. While there is no way to know exactly how much money a TIF district will generate, a recent study contracted by MRA showed that the Downtown Core alone could generate much more than $50,000,000 for reinvestment over a 20-year period.

What can TIF revenues be used for?

TIF can provide a source of revenue to enable the local community to implement its vision for the Metropolitan Redevelopment Area. Funding may be spent on anything allowable under the Metropolitan Redevelopment Code, including public-private partnership redevelopment projects, infrastructure improvements, land acquisition, expanded community services, affordable housing, and many other projects intended to spur economic development.

TIF funds can support existing businesses, by investing in rehabilitation funds, area marketing and branding, and other support services local businesses need. Local residents will benefit from new infrastructure, such as sidewalk, park, and street safety improvements. Redevelopment projects in TIF districts can also include affordable housing and mixed-rate housing developments, providing a variety of needed housing options to meet the community’s needs.

When will we see the money?

TIF districts will be able to generate a reliable and sustainable source of funding for a period of 20 years. However, not all TIF district revenues are generated at once. Before any TIF funds can be received, the County (for property taxes) and the State (for gross receipts taxes) must establish a baseline of existing tax revenue in the TIF boundary area. That process can take up to one year from the time of notification that a new TIF was established. After the baseline tax revenue is established, the taxing entity will begin to collect and distribute the TIF revenue, which depending on the source of the funds, may take up to another year. Even after new development starts, TIF revenues may be slow to increase due to the length of construction projects. However, as projects develop and the tax base expands in a TIF district, TIF revenues are expected to increase exponentially over the life of the TIF district. To fund large projects, the City may also recommend bonding against future TIF revenues.